Aat Cost Accounting and Budgeting

At BPP we build careers through education. Bookkeeping and accounting offer many career options.

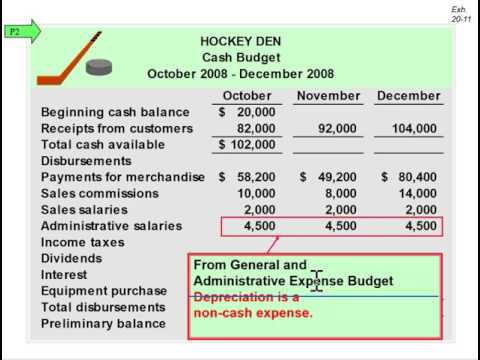

Preparing A Cash Budget Youtube

I have learn a lot of knowledge of this book and i have passed my business accounting paper So i am new class and i want to get managerial accounting book.

. Skills Level or Applied Skills Papers. This unit gives students a basic introduction to costing while building a sound foundation in the knowledge and skills they need for more complex costing and management accounting units such as Advanced level Management Accounting. Management Accounting P1 Youll learn the importance of costs in the production analysis and use of information for decision-making in companies.

We are committed to provide specialist knowledge and professionalism. They draw from AATs world-leading qualifications and will quickly build your knowledge on key topics including bookkeeping budgeting and cash flow. We discuss the education required job outlook and salaries for bookkeepers and accountants.

If you are a tutor or administrator at the college you can place bulk orders for your students with free delivery to the college by contacting our. This Level 2 qualification Level 5 in Scotland prepares 1619-year-olds for junior and entry-level accounting roles. Choose from Law Accountancy Data Technology Financial Services and more.

Types of cost and cost behaviour. Management accounting by Colin Drory. Bachelor of Business Professional Practice you will receive 2 semesters of credit equivalent to 96 credit points.

Budgeting forecasting capital budgeting. OR ACCA Papers F1-9 CIMA Operational and Management Levels or equivalent. You can only amend the tax code of an order if it has not been receipted andor matched to an invoiceOnce you have found the order click Update then select Change Amount from the Actions drop down list and click GoThen select Manage Tax from the Actions drop down list and click GoThis will display the tax screen where you then click on Additional Tax Information.

Nature and purpose of management and cost accounting Classification of cost and study of its behaviour and purpose Computer spreadsheets and business mathematics. This is only available for entry to a non. It entails preparing source documents for all business transactions operations.

This is only available for entry to a non-Accounting major in the Bachelor. P1 covers short-term budgeting and making short-term decisions on products and services as well as digital issues in costing. AAT Business Finance Basics.

AAT Business Finance Basics are a series of online e-learning courses covering the core financial skills every business needs. It introduces you to more complex accounting tasks such as maintaining cost accounting records and the preparation of reports and returns. We offer flexible delivery timetables to suit your needs delivering one-to-one hand-on training.

Books of prime entry and control accounts. Marginal and absorption costing. Enter the email address you signed up with and well email you a reset link.

Financial Planning Analysis Budgeting Forecasting Sarbanes-Oxley and Internal Audit. All businesses benefit from having a structured approach to expenditure and resource allocation for meeting the company expenses. The corporate governance problem of transaction cost theory is however not the protection of ownership rights of shareholders as is the agency theory focus rather the effective and efficient accomplishment of transactions by firms.

Standard costing and budgeting Cost accounting techniques Decision-making techniques. Member of AAT with 8 years overall experience in Accounting. Book AAT exams centres in London Watford Birmingham UK.

Transaction cost theory considers that managers or directors may arrange transactions in an opportunistic way. The level 4 qualification is the second level of the AT SA Accounting Qualification. ATT AAT ACCA CTA with many also IPSE accredited.

Approved AAT Training Provider. We are accredited by AAT NCFE and OCR Oxford. He joined RMA Group in September 2011 bringing with him invaluable experience gained from working in the construction materials industry in Turkey.

Discrepancies arise in business budget planning either because of unforeseen circumstances or poor planning. Advantage of using an outsourced accounting is that the total cost of services is less than hiring a full-time employee in most of the cases. We offer a number of different ways for college and university staff and students to order.

AuditingAccounting up to final accounts Financial. CPB Exam Certified Professional Biller is comprised of 200 multiple-choice questions an in order to have CPB certification you will have to pass CPB TestBookkeeping is the recording of financial transactions and is a component of the accounting process in businesses and other organizations. Book for AAT Level 2 AAT Level 3 and AAT Level 4 assessments.

Burak Demirtas holds an MBA in Finance Accounting from Yeditepe University Istanbul and an MSc in International Management from University of Sussex. It delivers a solid foundation in finance administration covering areas such as double entry bookkeeping and basic costing principles alongside complementary business communications and personal skills. Offering programmes for businesses and learners across every level.

Costing and Professional level Management Accounting. AT SA Level 4 FET Certificate. Our training programmes include extensive use of modern accounting software like Sage QuickBooks SAP SAPA SAGE Compliance Excel Xero and Sage One.

A first or second class degree in Accountancy Accounting and Finance or business related area with significant accounting related content from a UK institution or international equivalent. You must complete the Advanced Diploma of Accounting if you want to study the Accounting major. OR A full professional accountancy qualification APEL may be available.

For further details of the benefits of opening an account with Kaplan Publishing please call us on 44 0118 912 3000. In such cases improper budgets might hamper the companys further growth and expansion. Ordering and accounting for inventory.

Manufacturing Cost Statement Accounting And Finance Accounting Basics Manufacturing

4 2 Activity Based Costing Method Managerial Accounting Managerial Accounting Revision Guides Activities

Activity Based Costing Examples Managerial Accounting Video Youtube

Absorption Costing Formula Calculation Of Absorption Costing

Aat Level 4 Credit Management Cm Part 2 Lsbf Live Revision 2018 Https Www Youtube Com Watch V A3la3hjout4 Credit Collection Management Youtube

Tutor Salina Loum Aat Level 2 Basic Costing This Unit Will Be Divided Into 5 Lessons Ppt Download

Comments

Post a Comment